Eli Lilly Just Admitted It's Been Price Gouging for Years

Its announcement that it will lower prices for insulin reveals a dark reality: the fact that it can cut prices at will is an admission that it's been preying on diabetes patients for years.

“We are excited to announce insulin is free now.”

So proclaimed the verified account @EliLillyandCo on Twitter last November.

Turned out that was a fake account. But it did reap an amusing reward, tanking the stock of insulin manufacturers, as this headline attested: “Eli Lilly Dives After Fake Twitter Account Promises Free Insulin; Takes Novo Nordisk, Sanofi With It.”

A few months later and the real Eli Lilly has announced its decision to cap out-of-pocket costs for uninsured and privately insured customers at $35 a month while slashing prices for its most popular insulin products by 70%.

That’s a major victory for diabetes patients reliant on these products. At the same time, it reveals a dark reality about medicine in America. You know how 1.3 million Americans with diabetes ration their insulin? And how one-in-seven daily insulin users spend around 40% of their income, after food and housing, on insulin? That’s not a grim inevitability. It’s the side effect of the extraordinary greed of pharmaceutical companies, working in beautiful synergy with the greed of other major players in our healthcare system. Maybe that should be included at the end of every pharmaceutical ad.

Drug companies have been cashing in on insulin for years. Though the inventors who discovered it originally sold the patent for a mere $1, rejecting the idea of profiting off of their discovery, insulin has skyrocketed in price over the last several decades. Partially by gaming the patent system, the drug companies Eli Lilly, Novo Nordisk, and Sanofi, who together dominate the insulin market, have successfully and repeatedly hiked insulin prices while insulating themselves from competition.

These price increases cannot be explained by improvements to insulin products over time. Rather, they reflect the sort of brutal price gouging that has become a staple of the American healthcare system, which in this case may even rise to the level of criminality. Last December, the office of the Illinois Attorney General filed a lawsuit against all three of the dominant insulin manufacturers, along with a number of other companies, accusing them of price fixing. According to Courthouse News Service, “The complaint singles out Eli Lilly in particular, noting the price for a dose of its analog insulin Humalog rose by 1,527% between 1997 and 2018.”

Currently, Humalog has a list price of about $275 per vial, up from $21 in 1996. Meanwhile, a 2018 BMJ Global Health study estimated the standard production cost for a vial of insulin at somewhere between $2 and $6. With the price reduction Eli Lilly just announced, Humalog’s price will come down to $66. What generosity.

Humalog’s price growth is extreme even in the mind-bogglingly inflated insulin market. But it does point to a broader trend of massive price hikes for insulin products.

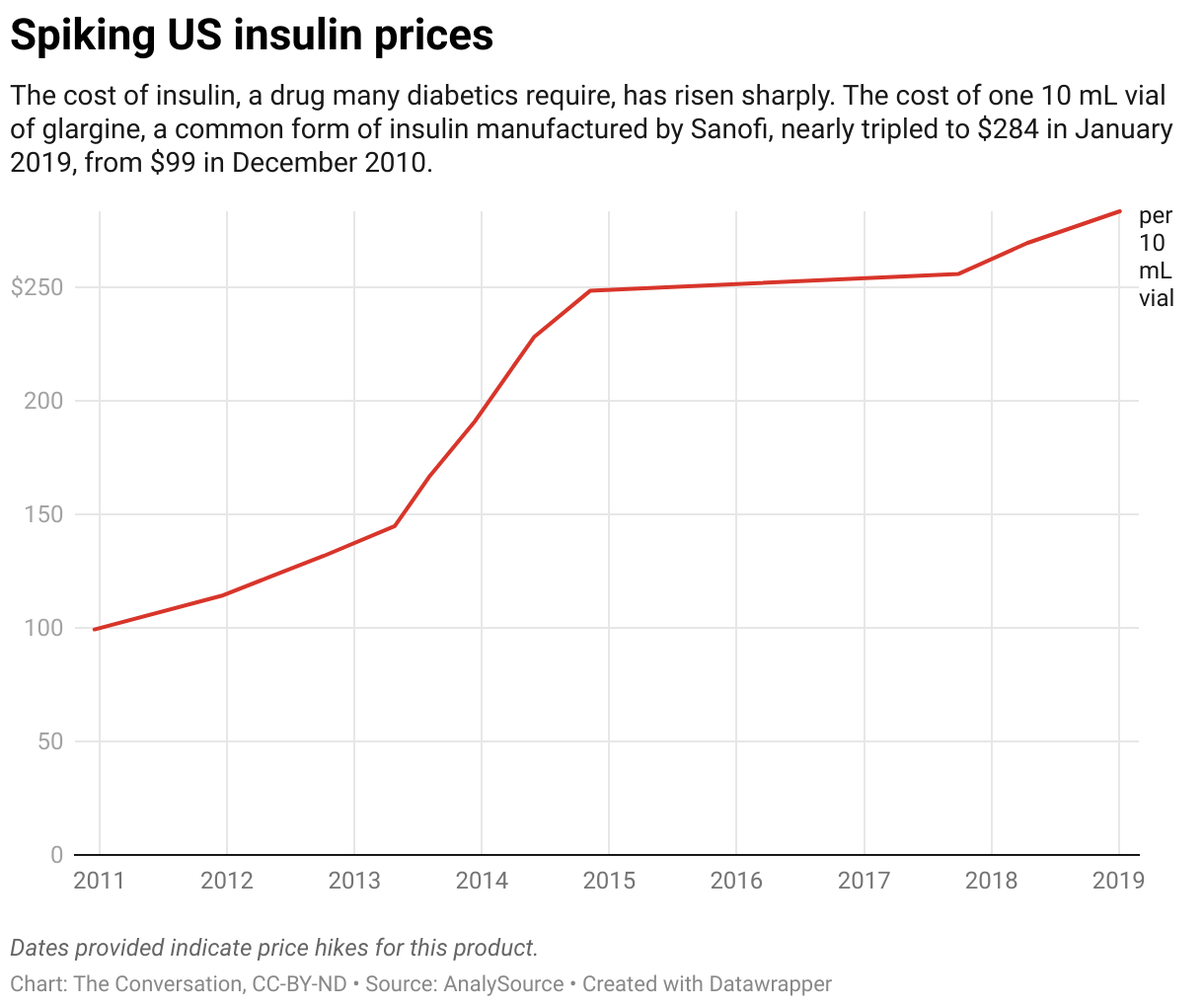

One representative example is the medication glargine, manufactured by Sanofi. Look at how much its price inflated over the 2010s:

Zooming out to the overall picture, a 2018 study from the American Diabetes Association found that, between 2002 and 2013, the average list price of insulin almost tripled.

As I’ve noted in previous posts, the US is exceptional in its high healthcare spending, which is primarily driven by the singularly high prices found throughout the American healthcare system. Insulin is the poster child of these exceptionally inflated prices:1

And where is this money going? Pharmaceutical companies consistently take home the largest share of spending on insulin, as shown in the graph below, though middlemen in the distribution process have made a play for a larger and larger share over recent years:

There are many ways to look at this. Disgust might be the first option. Anger is another.

But I think it’s useful to frame this in terms of redistribution. Because that’s what we’re seeing here: plain old redistribution. Just in this case, it’s not the pleasant kind where we redistribute from rich to poor. Instead, what’s going on is redistribution from diabetes patients to all the players in the insulin supply chain. And, given that those paying the highest costs are those without good insurance, who tend to be poor, we’re to a significant degree seeing a very unpleasant redistribution from poor to rich. (Consider that the CEO of Eli Lilly made $19 million in 2021.)

The fact that Eli Lilly is capable of reducing its list prices by 70% and capping out-of-pocket costs at $35 a month makes this point clear. It hasn’t been setting prices with an eye to fairness and compassion. It’s just been trying to maximize profit. Now that the federal government has capped monthly insulin costs for seniors at $35 and more competition is trickling into the insulin market (both from other private companies and from the state of California, which is building up public capacity to manufacture insulin), Lilly is seeing the writing on the wall. A new strategy is in order.

As Malcolm X once said, “If you stick a knife in my back nine inches and pull it out six inches, there’s no progress.” Yes, it’s good that one of the major insulin producers just pulled the knife out a bit, but that shouldn’t distract us from the real solutions. How about a universal price cap (as Biden has proposed) to start? And really, we need single payer ASAP.

Subscribe!

If you enjoyed this post, please subscribe! You will be notified when my posts go up and will have the newsletter delivered directly to your inbox.

And share!

And please share! I’m building this newsletter from the ground up, so everything helps.

Share this post:

Share Objective Propaganda:

Other Recent Writing

Check out my recent post at People’s Policy Project: “Social Security Full Retirement Age Increased by 2 Years While Life Expectancy Decreased 0.4 Years” (2/27/23).

Also, at Fairness and Accuracy and Reporting:

“The Washington Post Is Coming for Your Retirement Benefits” (2/24/23)

“Bret Stephens Says Journalists Admitting Values Would ‘End United States’" (2/28/23)

Source data here. Data comes from a 2020 Rand Corporation Research Report titled “Comparing Insulin Prices in the United States to Other Countries.” It can be found in Table A.3 on page 20. It’s worth noting that the list prices are not the final prices for insulin products, which are incredibly opaque. As this article points out, “Drug manufacturers compete for their business by offering generous discounts, which gives them every reason to set their initial prices high.” However, it continues, “Even if those discounts cut 50 percent from the price, RAND's study noted, Americans would still be paying several times more for insulin than what people in other countries pay.”