The Key Data for Understanding French Pensions

Projections from an independent advisory panel have for years shown French pension spending to be on a sustainable path

Pension reform just passed in France—against the will of most French citizens and in a move so anti-working class it gave Jeff Bezos’ newspaper a boner. Readers of American media were treated to pretty awful coverage of the event, as I documented for FAIR last week. The reform was supported by the editorial boards of the Washington Post, Bloomberg, and the Wall Street Journal, with the Financial Times joining from across the pond. The New York Times sat this one out, though it enthusiastically backed the French government when it raised the retirement age in 2010.

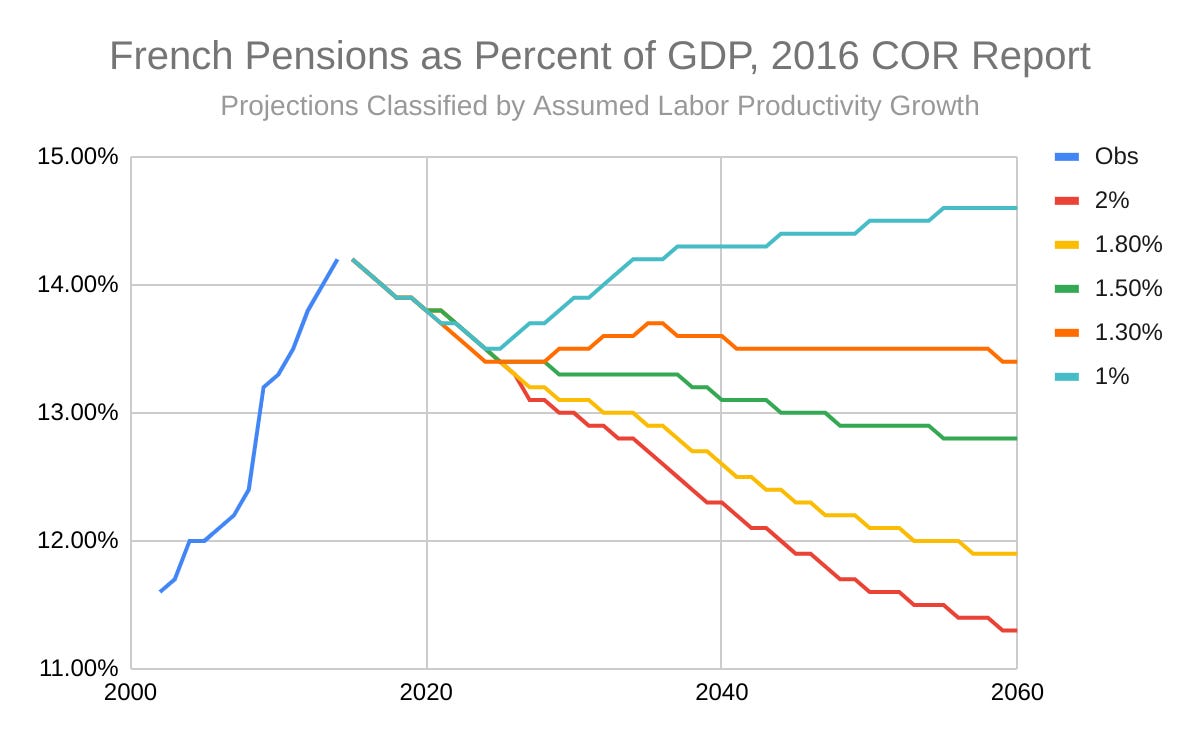

A notable aspect of the debate over pension reform in American media is that it has focused on the unsustainability of French pensions while failing to address an important point: estimates have for years projected at most a very modest increase in pension spending as a percentage of GDP in France over the coming decades.

Of all of the editorials I reviewed for FAIR, five included references to the supposedly exorbitant amount France spends on pensions as a percentage of GDP. None mentioned that, even without a rise in the retirement age, this spending is likely to decline over the next several decades.

In my article, I cite estimates from the European Commission in its 2021 Aging Report, which project a decline of 2.2% in public pension spending in France from 2019 through 2070. In a previous post for Substack, I had cited estimates from the Pensions Advisory Council (COR), an independent advisory panel tasked with monitoring the French pension system, which in its 2022 report returned an increase in pension spending through 2070 only in the most pessimistic of the four scenarios modeled.

The editorial boards just ignore this information. And this refusal to address the projections doesn’t seem to be limited to the opinion pages. The Wall Street Journal’s most comprehensive piece on the state of the French pension system, which includes projections from the COR regarding the worker-to-retiree ratio and the pension system deficit (both useful for stoking fear about future finances), doesn’t include projections for pensions as a share of GDP.

The failure to inform the public about these projections is all the more galling when you consider that they represent the key data for assessing the sustainability of French pensions. The pension spending-to-GDP measure reflects the actual cost of the system in terms of the wealth of the country. A deficit in the pension system could be run up because the government decides to contribute less of its revenue to financing the system, but that does not necessarily signal unsustainability, just an unwillingness of the government to support the program. What matters is the underlying cost of the system, the claim that it is making on the country’s wealth. Again, this is embodied in the pension spending-to-GDP measure.

In light of the apparent unwillingness of American media to put information about this measure front and center, I’ve decided to compile the projections included in the last eight COR reports, going back to 2015, and reproduce them below. You can find the source data here.

There’s a decent amount of variation in the projections—the most pessimistic forecast for 2070 ranges from 13% to almost 15% depending on the report you consult—but the general conclusion is clear: reports going back to 2015 have without exception established that French pension spending is on a completely sustainable path, one that certainly does not call for cuts.

Subscribe!

If you enjoyed this post, please subscribe! You will be notified when my posts go up and will have the newsletter delivered directly to your inbox.

And share!

And please share! I’m building this newsletter from the ground up, so everything helps.

Share this post:

Share Objective Propaganda: